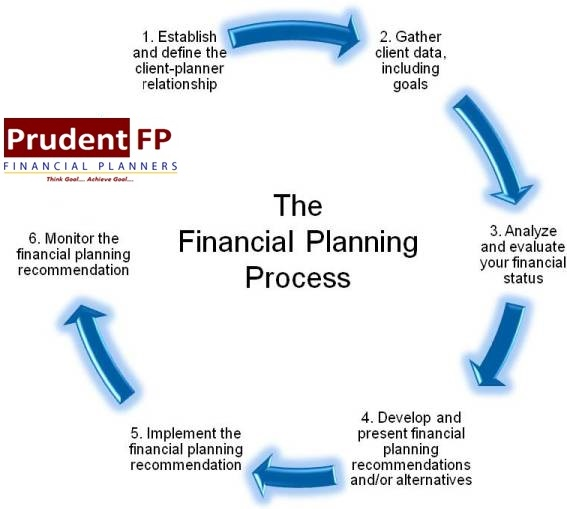

The preparation of the Financial Plan is a multi-dimensional process. We follow the below process for the Financial Planning engagement.

Client Service Agreement

When you utilize our financial planning services, you share financial and other personal information with us that is normally not shared with anything else. The client-planner relationship presupposes a very high level of trust between the two parties. Consequently, we are under obligation to maintain utmost confidentially of this information. To prevent unnecessary litigation and disputes in the future, it is recommended that we should enter into a client agreement which formalize the relationship with you and establish the basis on which the service would be provided. Such an agreement is also referred to as the “Letter of Engagement”. That’s why you will have to be signed at our formal Financial Planning our “Letter of Engagement”. This document is meant to reduce confusion and misunderstanding not only by disclosing important information about how we are compensated and the companies with which we do business, but also clearly defining the level of service you can expect from us.

Risk Profiling Analysis

By using our Risk profiling system, you obtain an accurate assessment of your risk tolerance in terms that are meaningful to you. Your Risk Profile report will guide you and your planner in your financial decision making. In particular, the report provides the basis for your instructions to your planner on the level of risk you would prefer.

In the questionnaire, you are asked about your attitudes, values and experiences. Your answers are scored against our parameter’s base and used to produce a detailed report.

Data Gathering Form

We will provide you a Prudent Data Gathering Form excel based which is to be filled accurately and completely to the best of your knowledge under the guidance a Principal Financial Planner. In Prudent Data Gathering Form, you will furnish us with complete and up-to-date information about your personal and family circumstances and investment objectives. It requires the planner to collect as much information as possible about the current resources, assets and liabilities of yours.

Document Submission*

You will provide scanned or Xerox copies of all recent statements which are being stated in Document submission clause at our email id sureshcfp@gmail.com This process will ensure that possible errors are minimized. It will also save your time, because in order to complete this data, you will need to locate the most recent statements.

*Note: All the artifacts, facts & figures shared by you will be kept strictly confidential and will be returned to you after the engagement is over.

Basic Preparation of Plan

Once all relevant information is assimilated, we will input basic information and your present financial situation include your pertinent assets, liabilities, current and projected cash flow, investment portfolio and tax implications as provided by you in initially data gathering from. A basic plan is prepared and sent across to you. We will set up a time & take you through the plan. Any new thoughts, scenarios, changes etc. which may come up, are noted for incorporating in the next version of the plan.

Final Plan Presentation

The Final plan will be complete with detailed, actionable recommendations. Once again we take the client through the plan and explain what we have done for them and the rationale for our recommendations. Once the client has understood the plan completely, the financial plan engagement comes to an end.

Execution of the Plan

We don’t sell any products or accept any commissions from a product manufacturer. However in our ongoing services after the financial plan is done, we do give recommendations on which particular product to buy and which is the most economical & convenient way to buy them.

But if you want to do it on your own… it’s perfectly fine with us. As long as you are implementing recommendations in some way… the client-planner relationship can be healthy and go on for a long term.

Monitoring and Review of the Plan

After a year, the plan is reviewed. Review is done to see whether the plan has progressed as laid out and whether any course correction is required. The process is similar to what was done in the first year – the idea is to continue the process and take it forward. The engagement needs to be renewed to carry the financial planning process forward. This is charged separately.

This, all engagement process will follow-up through mails/ calls/ Skype: As & when required.

For further enquiry, you may email us at info@prudentfp.in or call us at +9198160 02197 and request for an appointment to discuss your requirement and proceed with the engagement.