Let us first begin with understanding what a financial plan is and what it can do for you. A financial plan enables you to construct a road map to achieve all the financial goals and unforeseen needs that may arise in one’s lifetime. It ensures that you are well equipped to deal with dynamically changing circumstances such as inflation and changing lifestyles. In the absence of a financial plan, you might not be empowered to accomplish what you have dreamed of achieving and might also be under-prepared to deal with contingencies.

If you want to plan for financial goals such as buying your dream home, a car, a vacation abroad, child’s education and their marriage needs and your retirement amongst host of others; prudent financial planning can come to your recourse. Through experience we can say that many vie for all the aforementioned goals, but lack of prudent financial planning and / or procrastination on executing the financial plan drawn, which in turn hinders accomplishment of financial goals set. So, it is imperative that a prudent financial plan is made, and is vigilantly and religiously followed so as to make your dreams come true.

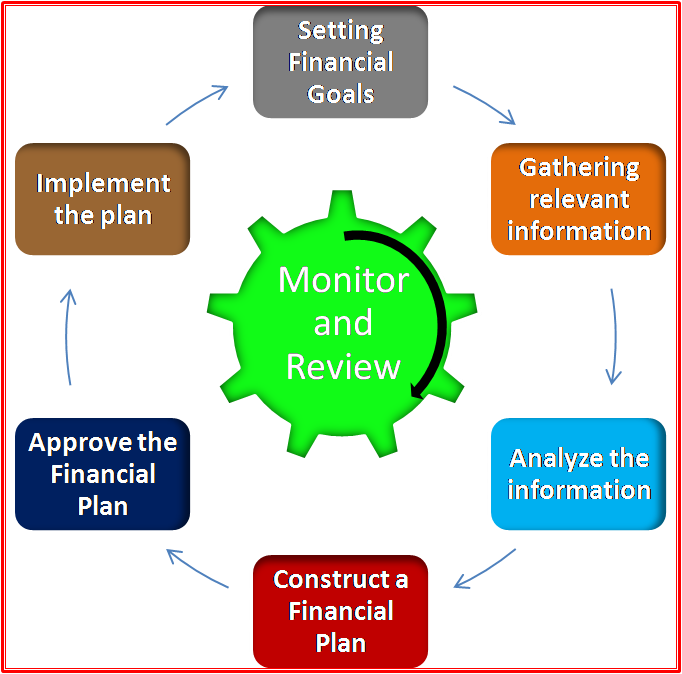

Achievement of any goal needs a well thought out plan. Similarly, achievement of your financial goals needs a financial plan.

A Financial Plan would help you answer these questions, and much more…

► What’s my net worth?

► Are Financial Ratio’s Healthy?

► How will Inflation affect my Financial Plan?

► What is my asset allocation?

► What is my risk profile?

► Are my savings being channelized efficiently?

► How much money should I have for contingency purposes?