Money is one the most vital part of our lives. We, all work hard primarily for money and money is what helps us live a life we aspire for. Every time, we are keeping in search of the best financial products which could able to enhance our money to meet our financial goals but most of us get in trap of the flawed financial products. Why is this so? We have to deal with financial questions like: which products to invest in for a secure financial future, how much of life insurance is enough, should we take a family floater plan, what are the best tax-saving options, how to get align financial products with financial goals… The biggest hurdle in getting answers to such questions is the vast array of financial products to choose from thousands of mutual fund schemes, hundreds of insurance products and fixed-income products, thousands of actively traded stocks… etc. We don’t have time to deal with all this. Most probably, the only time we may fix our finances is over the weekend. But the weekend is for our friends and family and leisure. We don’t want to waste it on figuring out financial products especially when the field is so vast and confusing, even savvy people are financially confused.

About us

Hence, we launched PrudentFP in 2011 founded by Suresh Kumar Narula, PrudentFP is a fee-only Financial Planning Service based out of Chandigarh-Panchkula. In the space of over the four years we have been helping our clients deal with various personal financial issues through proper planning which making their journey less stressful, more fun, and more successful. You already know our philosophy- we believe that first step not making investments but planning for everything and then executing it. Our goal is not limited to Insurance Planning or Investment Planning. In fact we are trying to make your overall Financial Life better and paving financial path for you, of which you can start walking. Your overall Financial Life is a made up of different components Insurance Planning, Investment and Retirement planning, Tax advisory etc. We take care of all these things. Our deep research and unbiased articles on all aspects of personal finance such as financial planning, life and health insurance, home loans, tax planning, psychology, mutual funds, estate planning and retirement planning , have stood the test of time.

Financial Planning – The Prudent Way

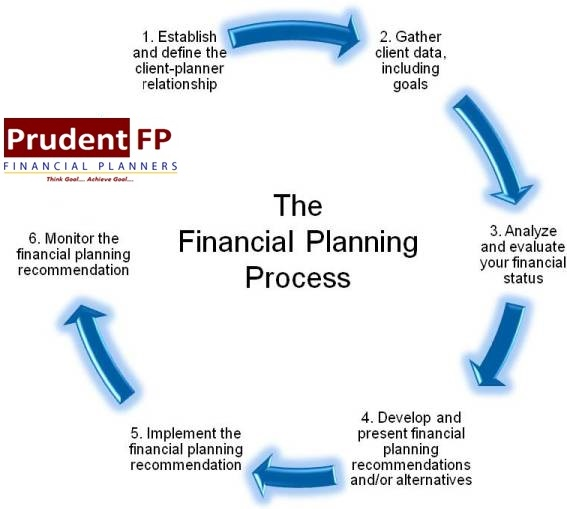

We provide a road map for your financial life. And, you can start right now – even if only a few steps at a time. In the Financial Planning, we help our clients realize their dreams and goals, financial advice, money management and selecting services and products that best meet each client’s need and goal fulfillment by building relationships and making path as the final decision comes from you, not us. We use a simple three step approach

We help you realize your personal and financial “GOAL”, why are you investing, what is the goal associated with your investment. Is it buying Home?, Buying Car? Vacation after 3 years?, Child’s education & Marriage and Retirement Planning?

We provide a “PLAN” to help you reach your goals, discuss opportunities that may be right for you and address any changes that may occur in your life and financial world.

We make decisions based on sound recommendations to achieve your financial objectives. Now you just have to take “ACTION” and don’t doubt it again and again, because you have cleared everything before.

Why people do not Plan?

There are many reasons why people may not undertake financial planning on their own, including the following:

- Thinking they have insufficient assets or income to warrant planning

- Assuming their financial situation is in good order

- Putting off what is complex and worrisome

- Not wanting to consider unpleasant events, such as death, disability, unemployment, or property loss

- Thinking financial planning is expensive

All of these assumptions are faulty. Of course, failing to plan ahead also costs money. The consequences of not planning include the following:

- Inadequate protection against personal catastrophes such as death, disability, serious illness, an automobile accident, prolonged unemployment, or other major negative events

- Too little money set aside for retirement or for the family’s educational needs

- Higher than necessary income or gift taxation

- Unplanned estates, with higher taxes and settlement costs

- Not reaching financial goals in life

Why you need Our Help?

Many people have inadequate skills in making informed, systematic decisions about their own finances. They have little exposure to good decision-making models. We help peoples identify their needs and good ways to meet them while avoiding potential obstacles. We incorporate elements of counseling, information management and processing, education planning, investment planning, income tax planning, risk management, retirement planning, and estate planning.

Some Praises for our Financial Planning Services from our Clients and other fraternities.

He is professionally very sound and is very hard working and intelligent guy…. very precise and eloquent in his area …… a sought-after financial advisor …

–VIKRAM SHARMA, Manager Accounts at Vardhman Textiles Ltd

Mr. Suresh Kumar ji has great knowledge of investment and tax savings”.

–CHETAN AGGARWAL, owner, at Agaresen Trading Company

Fruitful results given to me and enhance my financial proficiency.

–AMIT GOYAL, Vardhman Textiles Ltd

Mr, Suresh is a guy you should be looking if you are planning to do financial planning and investments”, –LOVE BINDAL, Vardhman Textiles Ltd

Suresh Kumar Narula is a very learned and experienced professional in the field of financial planning. His commitment to his profession is amply demonstrated by his having got registered with SEBI as Investment Adviser and his efforts for creating financial awareness through his writings, among other things. His making financial strategies/plan before recommending any financial product and explaining logic behind each recommendation speaks of his worthiness to be sought as a trusted financial planner by any investor. –SUKHWIDNER SIDHU, RIA, CFPCM

It is a very brave decision to carve out a business out of Fee Based Financial Planning in India today, as the industry though fast growing is still new. Because financial planning is an art and not just a product which people mostly percieve it as. Hence, it does take a courageous visionary + the will to do the right thing for such a thing. Mr. Narula encapsulates all these qualities and more, and he does so with panache! Always self motivated and his drive to refine the financial advisory industry is inspiring. I wish him success for all his future endeavours and look forward hearing more of his achievements in the industry.”

– NICKLESH ANANDAN, Assistant Vice President at R Wealth

Suresh has been my FP for almost a year now, he keeps himself updated with the latest development in wealth management, products and services. The returns from the investments he had recommended have been good”, –PARVESH BANSAL, HR Coordinator HLS Asia Ltd.

Very helpful Person Always Give Good Suggestion to anybody Regarding Financial Issue I appreciate him.” –HEM FULARA, OMCR Engineer & O&M Engineer

Suresh has been known to me for 3 years now and has been a great friend and motivator. He is an excellent financial planner and his blogs have made a great impact for all of us.”

-SUBHABRATA GHOSH, Director at Steps Ahead Investment Advisors Pvt Ltd

Suresh sir is one of the pioneer of Financial Planning field, and his articles are the biggest contribution towards Financial literacy and investor awareness.. I strongly recommend his expertise for everyone who is looking to change his/her Financial life.” DHAWAL SHARMA, Director at Urja Wealth Creators

Suresh Kumar Narula is a peer and we know each other being a member of Financial Planners Guild India, an association of financial planners in India, committed to advancing the financial planning profession in India.

I found Suresh to be a simple, humble, great listener and someone who believes in Putting Client Interest First. Suresh’s commitment to the financial planning profession is excellent and the fact that he has already become a SEBI Registered Investment Adviser is a validation of it.

Wish him great success in his new endeavor and I sincerely believe that clients who believe and trust him will benefit immensely from his financial planning and advice recommendations.”

PARTHA IYEGAR, Choice Architect for Youth, Family Counsel and Wealth Planner for Families

Suresh Kumar Narula has been working with me for over an year and his performance has truly been outstanding. He is gifted with an attitude to take challenges head on and in turn rub the positive energy on the rest of the team. He is a fast learner and accompanied with his sharp analytical skills and knowledge of equity capital markets, no challenge is too huge for him. His findings were appreciated by clients . Added to his superior skills are his professionalism and team spirit that will make any Manager proud of his presence in the team.” VINIT KUMAR CHOWDHARY, Works @ Institute of Management Technology Hyderabad

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in