Nobody wants to invite inevitable troubles at the time and after filing of income tax returns. However, inadvertent mistakes and ignorance of income tax rules while filing of income tax return may lead to a tax payable or refund situation or rendering the return as invalid, amounting to a defective return causing agony of issuance of a defective tax-return notice. Come July and taxpayers wake up for filing the return for taxpayers to pay taxes and report their various sources of incomes in typically form part of the ITR form need to be read with utmost care. This time I-T department has been extended from the last date of 31st July to 31st August, applicable to all individuals and HUFs. However, many wait till the last few days, to file their returns in hurry and commit some typical mistakes that can be avoided while filing of income tax returns, if they do their numbers systemically and make the process of tax filing smooth. Though tax filing can be scary and may be rocket science, only thing being one should be aware about to choose the right ITR form, a large bunch of documents needs to be collated and fill in the right information.

Here, checklists are following in which you should be ready with all the paperwork and keeping tabs on your tax burden to avoid penalties.

Collate the Documents

Before choosing ITR form and filing of income tax return, firstly you have to collect your TDS certificates from your various bank branches and ask employers for Form 16, if not obtained already. On savings and investments front, you need to put together your all bank pass books, mutual fund, brokerage and loan statements, to calculate interest on bank fixed deposits (FDs), recurring deposits (RDs), non-convertible debentures (NCDs), corporate bonds, tax-free bonds, other small saving schemes and PPF; dividends from stocks and mutual funds; rental income, capital gains from equity and debt; details of investments for 80C and other deductions, loan repayments history, advance tax payment data and so on. After assembling all the documents, you are ready to compute your taxable income and your tax liability. Should you do it yourself or employ a tax planner? If you are involved in complicated financial transactions, have business and/ or rental income, capital gains and expenses or are filing tax returns for the first time, you may want to get a tax planner’s help. But, in most other cases, you can do it yourself. Once you are aware of tax intricacies and how your data translates into tax calculations, it is just a matter of familiarizing yourself with the I-T department’s e-filing process.

Matching with Form 26AS

Once you assimilate your TDS certificate on salary sources is as per Form 16 and TDS from ‘other than salary source’ is as per Form 16A, all the TDS entries in Form 16 and 16A should appear in Form 26AS for you to get credit for the tax already paid and should match every TDS entry such as gross amount, date of deduction, amount of TDS deducted etc. with their bank and salary records before filing their returns. Form 26AS is akin a passbook of tax credits as it shows the tax-deducted-at-source (TDS) and advance tax and self-assessment tax payment for which you can get credit while filing tax returns. Remember, it is final conclusive evidence and the heart of it all to claim the credit of tax deducted in your tax return. You should need to check Form 26AS periodically throughout the year and not just at the end of the financial year. You can obtain it from your net banking, I-T department website or directly from TDS centralized processing cell. While matching all numbers, you should ensure that every tax entry in 26AS shows ‘Status of Booking’ as ‘F’, i.e., ‘Final Status’. If it shows ‘U’, the deductor has made a mistake. If the TDS deducted is not reflected in 16/16A/26AS, you can file a grievance with the I-T ombudsman or to make a complaint at different levels in the bank/company, before approaching the I-T ombudsman for obtaining redress.

Non-filing of Return

There are many myths among taxpayers, especially senior citizens about non-filing of returns when Form 15G and15H has been submitted to permit bank not to deduct tax at source even if their interest across FDs crosses Rs10,000 in the financial year and TDS or advance taxes have been paid to the authorities. They prone to think that they do not need to file their return on the pretext of already submitted Form 15G/15H with their banks and their income level is below the threshold limit, which may invite a show cause notice from I-T department for non-filing of returns. It should be noted that if you submit Form 15G/15H and your FD interest crosses Rs10,000 in the financial year or paid taxes periodically, your Form 26AS will still reflect it even though there is no TDS. Income Tax department can easily track the interest paid to you with or without TDS. Though your bank FD interest has not reached Rs 10,000 and even bank does not deduct tax, you should still fill your return, based on your consolidated income during the year as it may owe tax and liable to pay advance tax, if the applicable taxes are above Rs10,000, otherwise, it can attract notice as well as penalty. Moreover, filing of return can help you when applying for loans, passport, visa, etc. The purpose of having a PAN card is to file tax returns. For individuals with income level below the limit of Rs2.5 lakh for individuals and Rs 3 lakh for senior citizen (which has been raised to in Budget 2014-15), tax returns are usually processed fast by the assessing officer (AO). For others, it can take time, especially for refund cases.

Choose Right ITR form

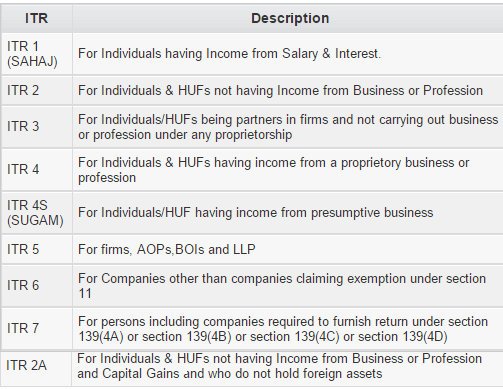

Every year, there are improvements to help you for smooth filing. This year I-T department has made major changes in their existing ITR forms with an introduction of a new ITR form 2A for individuals and HUFs not having Income from Business or Profession and Capital Gains and who do not hold foreign assets. As regards bank account details in all these forms, only the IFSC code, account number of all the current/savings accounts which are held at any time during the previous year will be required to be filled-up. You need to know who should file returns, which ITR forms to use and what is taxable. For instance, you may have put Rs1.50 lakh in PPF by March 2015, having dividend income and purchased Rs 1 lakh tax-free bonds which have a coupon rate of 8% to 9% and received the annual tax-free interest on it, which is exempt under of Tax Treaties, have to declare this income in the Schedule EI (exempt income). In such case, you cannot file ITR-1 (Sahaj). This is because the tax-exempt income will cross the limit of Rs5,000 allowed for ITR-1. You will have to file ITR-2, in this case. Similarly, you should be aware about all other forms like ITR-4, ITR-5 and ITR-7 for other business incomes.

Using e-calculator

Once you are done with number crunching of different segments of income, the deductions and tax payments already made, it is time to verify your tax liability or refund, before you e-file. You need to verify your computation using one or more online, or offline, calculators. Even the smartest can make dumb mistakes and it is far better to catch it before e-filing than going through the process of tax return amendment. For example, I-T department is now offering java tool option, along with Excel, for tax filing. The java tool has a better look and feel than Excel and is also easier to use.

Dispatch ITR-V

The tax e-filing process would be completed only after the taxpayer submits the verification of return (in ITR-V) to CPC Bengaluru by ordinary or speed post within 120 days of filing return, if no digital signature is being used. Failing to send ITR-V or sending without signature within stipulated time, your return would be treated as null and void. To put an end to sending paper-based acknowledgement of e-filed income tax returns (ITRs), I-T department is planning to send a one-time password (OTP) on taxpayers’ mobile phones which will be valid for 24-hours after verification from the Aadhaar database, which would need not to be sent a physical copy of acknowledgement ITR-V to Central Processing cell.

Conclusion

As per the new rules, taxpayers filing their returns this year will have to mandatorily share their personal email ids and mobile numbers. A single mobile number or email id can be used for a maximum of 10 user accounts as the primary contact. Often, taxpayers are daunted by the details required by ITR. Sometimes, they are flawed to make return filing without taking help; e-filing can be done with paid e-filing services or for free on I-T department’s website. Overall, the I-T department system has improved over the years. You would be heard individual horror stories that can shake you up but keep the faith. If you paid your taxes in utmost good faith, there is nothing to fear. Keep your documents ready as proofs, in case of any scrutiny.

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in