All over world, cancer is rising at an alarming rate and it can happen to anyone. With a million new cases being reported every year, it is the second biggest killer after heart disease in the world and seems to be tightening it’s also grip on India. No one wants to get diagnosed with Cancer, but the fact is that the risk of getting cancer is high. Though chemotherapy is covered by health insurance, the disease itself has financial implications beyond healthcare. Cancer not only adversely impacts our health but can also lead to disruption in family members’ life style, long-term absence from workplace and possibly loss of job. Treatment of cancer is very expensive and can range from Rs 3 lakh to more than Rs 20 lakh. Branded imported cancer medicines can cost a bomb, with expenses running into several lakhs of rupees for medicine alone. To financially protect against this giant disease, HDFC Life has recently launched its innovative Cancer Care, a critical illness product covering diagnosis of early, or major, stages of cancer. This comprehensive product differs from other critical illness products in the market which cover only major stages of cancer and HDFC Life Cancer care covers early stage cancer and carcinoma-in-situ (CIS) which are excluded by other products and provides lump sum benefit on diagnosis of Cancer.

Various plan options and defined benefits

The plan offers flexibility to choose from three options with varied benefits. The silver plan pays 25% of sum assured on diagnosis of early stage cancer or CIS and diagnosis of major cancer will pay 100% sum assured minus early stage cancer or CIS claims, if any; the premiums are also waived for three policy years, in case of the outstanding term is less than 3years then premiums for the outstanding term would be waived. The product has no death benefits or maturity benefit. HDFC Life Cancer Care has option of a gold plan which has benefit of sliver plan plus feature of sum assured increase by 10% of initial sum assured every year. This increase will continue till the earlier of increased sum assured becoming 200% of the initial sum assured or any claim event. There is platinum plan which has benefits of gold plan plus income benefit equivalent to 1% of applicable sum assured would be paid out to you on diagnosis of major cancer for a fixed period of the next 5 policy years.

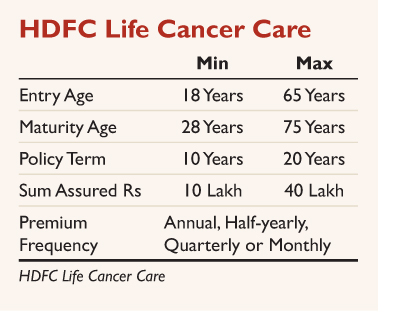

Eligibility and Premium

The annual premium for silver plan is a Rs20 lakh cover for a period of 20 years being available to a 35-year-old male is just Rs1,900 plus taxes. But this premium is only guaranteed for three policy years, it means your premiums shall remain unchanged for a period of three years from the date of issue and revised premium after that will be offered for another three years. If you buy critical illness product covering 35 to 37 illnesses for the same sum assured, you will pay 3.5 to 4 times higher premium. You can get several illnesses covered for premium of Rs6,500 to Rs7,500 plus taxes. But these products do not cover early stage cancer or CIS.

Limitations of Plan

The premium guarantee is for three years and subsequently for a block of three years. A couple of life insurers offer critical illness product with premium guarantee for five years. There is specific definition of early stage cancer and CIS which is stated in product brochure. For example, early stage cancer means presence of one of the five defined malignant conditions. Similarly, CIS means histologically proven, localised pre-invasion lesion meeting certain conditions for specified organ groups. The product covers only cancer; there are other critical illness products which cover up to 37 illnesses. There is no medical test. While it is convenient, it can also lead to disputes about when the cancer was triggered. The coverage is after a waiting period of 180 days. There should be 7 days survival period between the date of diagnosis and the date of eligibility of benefit payment. The policy excludes pre-existing cancer for which the customer had signs, symptoms, diagnosis, medical advice or treatment within 48 months prior to the date on which the policy was issued.

Should you get insure yourself

Those with family history of cancer can consider buying this product even at a young age. It may work out better than critical illness product covering a large number of illnesses. Instead of believing that “I will not be the one”, you should insure yourself because it helps to protect your income and savings from expenses that aren’t covered by your major medical coverage, like Out of pocket medical expenses, Out of Network specialist, Experimental Cancer Treatment, Travel & Lodging etc. when treatment is far and so on.

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in