With regard to attach social and sentimental value to gold, people are often lured to buy gold on festive seasons such as Dhanteras and Akshay Tritya with the objective of either use for consumption or accumulate it as part of their investment strategy. According to the World Gold Council, India is the largest importer and consumer of gold, which created high current account deficit in recent years. It has been suggested that some ways should be devised to recycle the gold stock available in the country in order to curb foreign currency. To that extent, the finance minister in his budget speech was announced in his last budget 2015 a Gold Monetization Scheme (GMS) with the three basic objectives to mobilize the gold held by households and institutions in the country, provide a fillip to the gems and jewellery sector in the country by making gold available as raw material on loan from the banks and reduce reliance on import of gold over time to meet the domestic demand. Since the gold is unproductive and dead asset today, this welcome initiative will make this asset productive and will help to covert physical gold into cash. But in order to put your gold to work and earn some return on this scheme, you would have to emotionally prepare yourself that your gold will have be melted to be monetized, which may not like the most of us.

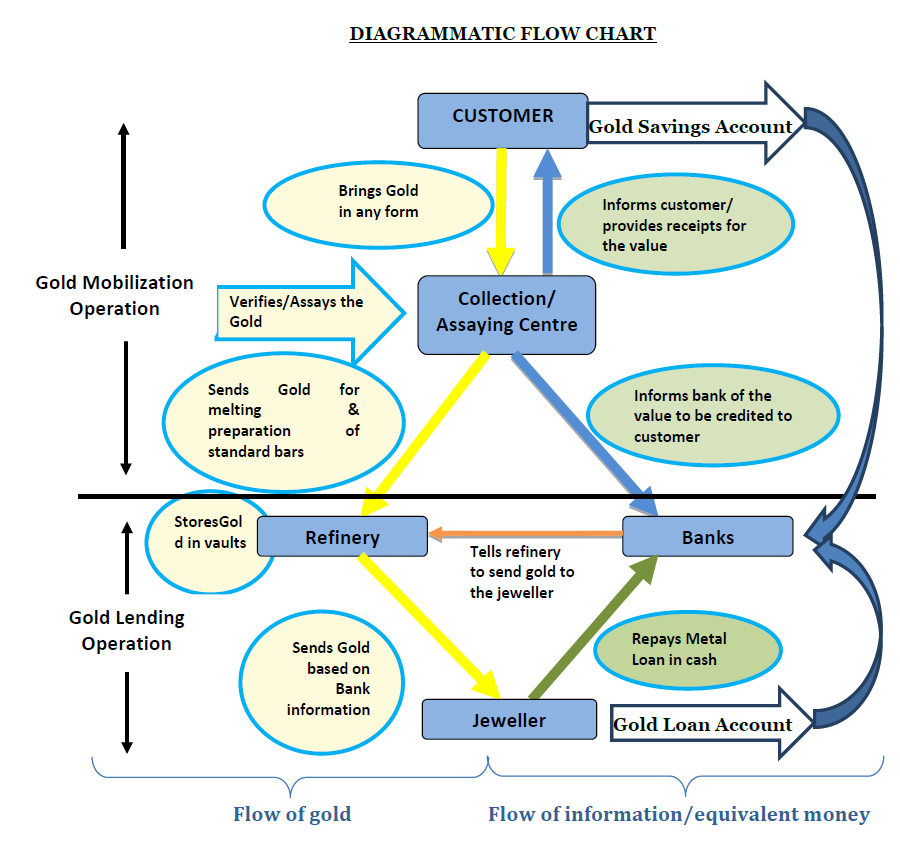

However, let’s see how the process is going to be melted your gold and converted into Gold Saving account in which banks would be able to use for lending purposes.

Purity Verification

Gold monetization scheme allows investors and institutions to bring the minimum quantity of gold at 30 gms in any form of gold i.e. bars, coins, any unused or broken jewelry or billions etc. to deposit with banks. To check the purity of your gold, you have to bring your gold for getting tested at any of 350 Hallmark Centers that are Bureau of Indian Standards (BIS) certified at a nominal fee. These centers may not necessarily be jewellers. They are engaged in certifying the purity of the gold that the jewellers manufacture on a daily basis. These Hallmarking Centres will act as ‘Purity Testing Centres’ for the GMS as they are well equipped to conduct a test of purity of the jewellery in a short span of time.

- Preliminary Test: In a Purity Testing Centre, your gold will be tested at a preliminary XRF machine-test and told you the approximate amount of your pure gold. If you agree, you will have to fill-up a Bank/KYC form and give your consent for melting the gold. If you do not agree to the XRF machine test, you can take your jewellery back at this stage. The time spent by you will be about 45 minutes in the centre up till this stage.

- Fire Assay Test: After receiving your consent for melting the gold for conducting a further test of purity, at the same collection centre, the gold ornament will then be cleaned of its dirt, studs, meena etc. The studs will be handed-over to you there itself. Net weight of the jewellery will be taken after such removals and told you. Then, right in front of you the jewellery will be melted and through a fire assay, its purity will be ascertained. Now, you have to choice of either refusing to accept in which case you can take back the melted gold in the form of gold bars, after paying a nominal fee to that centre; or you may agree to deposit your gold in which case the fee will be paid by the bank. If you agree to deposit the gold, then you will be given a certificate by the collection Centre certifying the amount and purity of the deposited gold.

Opening of Gold Savings Account with the banks

When you produce the certificate of gold deposited at the Purity Testing Centre, the bank will in turn open a ‘Gold Savings Account’ for you and credit the ‘quantity’ of gold into your account. Simultaneously, the Purity Verification Centre will also inform the bank about the deposit made. While opening account, you have to option of redeeming the deposited gold in either cash or gold. The tenure of the deposit will be held with minimum period of 1 year and with a roll out in multiples of one year. Like a fixed deposit, breaking of lock-in period will be allowed.

The amount of interest rate to be given is still to be left to the banks to decide. The bank will commit to paying an interest to you which will be payable after 30/60 days of opening of the Gold Savings Account. Both principal and interest are to be paid in the form of value of gold. For example if you deposit 100 gms of gold and gets 1 per cent interest, then, on maturity you would have a credit of 101 gms after 1 year.

The government is likely to exempt the interest income as well as any gains in principal from Wealth Tax, Capital Gains as well as Income Tax. So, to that extent, the tax angle on this is extremely good.

Melting Charges and other fee

The process is described as above it appears that it will not be served as you thought. You will have to bear melting charges about thousands of rupees to the tune of minimum charges from 100 gms to 1000 gms for Rs 500, 600,700 per lot and so on, with the span of every increase of 100 gms. Besides, testing/fire assaying charges are fixed for any quantity of gold for Rs 300 and other charges such as stone removal and melting charges would also be payable by you at actuals. Moreover, you will also have to entail a loss in terms of making charges 10-25% and will be have to be paid by you again if you get the gold converted back into jewellery.

Although the intention of monetizing gold is good, its process seems to be cumbersome and may not generate a positive income net of charges. If you buy gold through a gold ETF or invest in a gold mutual fund then this can prove to be better alternative to that because the tax angle on this is very favorable, and not only do you benefit from gold appreciation you benefit from interest as well.

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in