Unlike US countries, India has not basic government pension schemes or old age doles that could provide some social and financial security to retired people in their sunset years. That’s why, Indian government has given some respite to build your some retirement corpus through mandatory retirement schemes such as the Employees’ Provident Fund (EPF) and the retirement investments people make on their own volition. As you aware that contribution to your provident fund, yours and your employer’s have already been accumulating at 12 percent of your basic salary that was earlier capped at Rs6,500 has, now been raised to Rs15,000 thanks to mandatory investment norms. With rapidly increasing the people’s income over the decade, this is an overdue and welcome move to accumulate more retirement funds for their rainy days. However, it does not mean that you are banked solely on it for your sunset years. With the life expectancy has already been gone up from 61 in 2001 to 65 in 2011, and an average urban Indian people living well beyond 80 and inflation eating up into its core, would still leave a large chunk of funding gap from this recent hike wage ceiling limit for mandatory PF from Rs6,500 to Rs15,000. If you don’t back up your alternative investments plan with your PF, your required retirement funds may be in sour and most probably not able to support your entire retired life.

Decoding EPF and EPS

Since all PF is trusted retirement scheme, mandated by law, mandatory for all organizations and has over five crore subscribers. The 12 percent of your basic pay as deducted in your pay slip and your employer make the same contribution towards your provident fund for your nest egg for the future. While decoding your EPF and EPS, you should understand that each month you have contributed 12 percent of basic salary goes towards EPF and you earn 8.75% p.a. tax-free interest and your contribution qualifies for section 80C benefit. In the same way, your employer has also contributed 12% as basic salary, out of which 8.33% of as per recent hike Rs 15,000 goes to Employee Pension Scheme (EPS) account, which is Rs1,250 a month whereas government also contributes 1.16% of wages towards EPS and 3.67% of employer’s share to EPF which makes total 15.67% (12%+3.67%) goes towards your EPF account. With effect from 1st September, a bad news for new members earning above Rs 15,000 as they would not get any employer contribution towards their EPF. From Pardeep’s perspective, he works for 35 years and his average salary is Rs45,000 per month. But, for pension purpose, the maximum salary would be considered only Rs15,000 which will give him paltry sum Rs7,500 (Rs 15,000 X 35)/70 a monthly pension for lifetime despite the recent hike. Though there is very little scope of accelerating your investments according to your retirement needs, a hike in voluntary contribution to EPF can only be intimated at the beginning of the financial year.

Testing EPF corpus

Since putting your money out of EPF is rather easy but it actually work against your retirement planning. Your money would not grow in as aligned with your retirement needs; you are left with a paltry balance which would enforce you to invest into other financial products like PPF, ELSS etc. Let’s take test of EPF corpus with hypothetical example when you retire at 58.

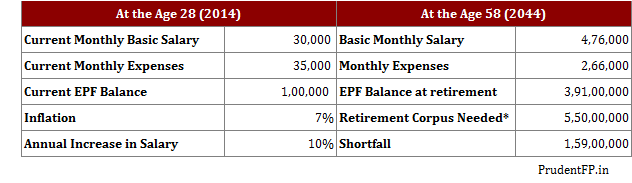

Assumptions: Since Indians are already living till age 78-80, we assumed life expectancy at 78 years. The total contribution towards EPF comprises 12% of basic salary and a matching from your employer minus Rs 1,250 towards EPS every month. Returns on EPF during and post-retirement have been assumed on corpus at 8.75%. *Retirement corpus at the time retirement is calculated after considering Rs 7,500 a monthly pension for the next 20 years. All figures are rounded off.

Assumptions: Since Indians are already living till age 78-80, we assumed life expectancy at 78 years. The total contribution towards EPF comprises 12% of basic salary and a matching from your employer minus Rs 1,250 towards EPS every month. Returns on EPF during and post-retirement have been assumed on corpus at 8.75%. *Retirement corpus at the time retirement is calculated after considering Rs 7,500 a monthly pension for the next 20 years. All figures are rounded off.

While assuming you are aged at 28 and intended to retire at 58, you would have good enough 30 years of work life to fund your PF and for pre-set goal retirement. Now, you are solely dependent on your PF and you play prudently and leave your PF untouched for 30 years, which is the most unlikely among Indians. Since you don’t have any other backup investments, after 30 years you would able to accumulate around Rs 3.91 crore while assuming you have a current EPF balance of Rs 1 lakh and your current monthly basic salary is Rs30,000. Now, assuming your pre-retirement monthly expenses at current cost is Rs35,000 and after adjusting inflation, your monthly expenses turns out to be Rs 2.66 lakh per month when you are 58 in 2044. According to this calculation, you should have your retirement corpus worth Rs 5.50 crore, which should be enough to see through the 20 years of retirement. But your accumulated EPF corpus would take care only for 15 years or till age 73. Thus, you are already starting at guaranteed penury of five years if you live till 78 and more you live, it will get worse situation as you would have to dependent on your children but Indian families are being nucleated, hence you would be naïve to be banking on it.

The situation may get more worse, if your wife outlives you for another five years, it will be 10 years of crunch her. What about a major uninsurable health episode in retirement? Clearly, you will need to invest over and above your PF contributions to secure your healthy retirement. The 12 percent contribution rate by both you and your employer do not meet the actual funding requirement for your sunset years.

Bridging the Gap

Since provident fund is a debt retirement investment whose capacity to beat inflation is limited compared to a result if some investments were allowed in stock and equity mutual funds. While expecting no major changes in the future in EPF investment front, you would need to have another growth engine for the retirement funds that has to be fuelled by your own EPF contribution. Start small via systematic investment plans (SIP) in diversified equity funds and the tax-saving ELSS schemes to fill the gap in your require retirement corpus. While considering a mid-cap fund with good track record, pick 3-4 large cap funds for pacing your investments in retirement funds. If you want to play safe, back your EPF up with saving in PPF of up to the permissible limit Rs 1.50 lakh. Once you cross 50, switch from high-risk investments like mid-cap funds to most large-cap funds into debt to secure your capital and gained return. It is again proved that putting all your eggs in one basket is never a good idea. Despite recent hike in EPF limit, would not be still enough for your rainy days.

The article got published at Dainik Bhaskar in 31st March 2015. Please click here

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in