‘Old is gold’, this adage is very much true about the National Saving Certificate (NSC) which has been a favorite investment option for every conservative investors, even from a tax-saving point of view. Though, it has been losing its shine in compare with other investment options available like PPF, ELSS, and unit-linked insurance plans, this article will rejuvenate to induce investors to save tax, to earn tax-free return and to make easy liquidity in the long-run by adopting our prudent approach.

Needless to mention here that NSC is a scheme floated by the Government of India and issued by post-offices. Investing in NSC is so easy, you can purchase in your own name, jointly by two adults or even by a minor through guardian in the denominations of Rs 100, Rs 500, Rs 1,000, Rs 5,000 and Rs 10,000 from any post office in the country having tenure of 5 years or 10 years. Unlike PPF has a maximum investment limit of Rs 1.50 lakh per annum one can invest with no maximum limit to the same. Though its accumulated interest is not tax-free which is to be added into your income under the head of “Income from other sources”, you can make free from tax while investing up to limit of Rs 1.50 per annum through NSC- ladder approach.

Tax-Free Interest

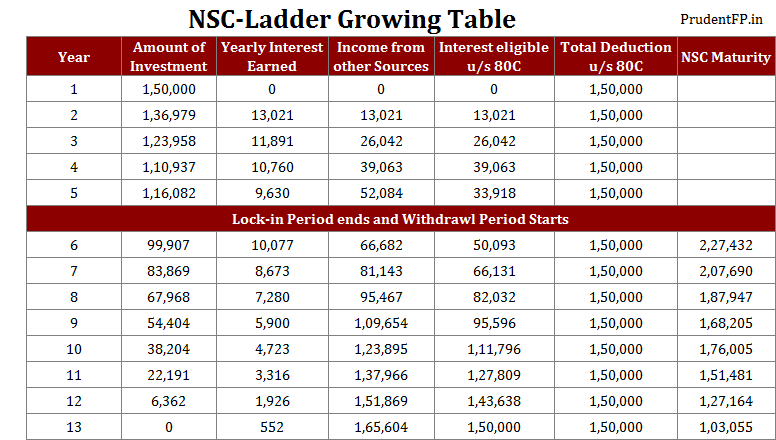

Currently, NSC is offering 8.50 per cent interest payable compounded half-yearly which means the effective rate of return per annum works out to 8.68 percent. Since it is a cumulative scheme with a term of five years, its interest accrues every year but it is paid to the investor together with the initial capital invested at the end of its maturity and to be taxable at the end of five years. But it is important to note here that you could make tax-free interest while investing up to Rs 1.50 lakh in NSC which qualifies for deduction under Section 80C of the Income tax act and have to declare the accrued interest on NSC on a yearly basis in your tax return under the head “Income from Other Sources” and get simultaneously deduction of accrued interest for every year under Sec 80C as it accrued interest get reinvested into NSC itself. By doing this, your taxable income would remain the same and making the interest in effect as tax-free. It can be illustrated as below the table:

While claiming full deduction under section 80C, suppose you have bought NSCs worth Rs 1.50 in the first year since you are long-term investor and to make its interest free in the next financial year, you should buy another NSCs worth Rs 1.37 lakh so that interest thereon worth Rs13, 000 is deemed to reinvest into NSC itself and simultaneously qualifies for a fresh deduction under Sec 80C, thereby making it tax-free in the second year and so on. Only the final year’s interest, when the NSC matures, does not entitle to get a tax deduction as it does not get reinvested, but is paid back to the investor along with the interest of the earlier years and the capital amount.

NSC-Ladder Approach

In the liquidity front, you keep getting maturity proceeds at the end of year 6, 7, 8, 9 and 10. These proceeds in turn have been reinvesting in further NSCs of five years, maturing at end of year 11, 12, 13, 14 and 15. This prudent approach creates a NSC-Ladder, where every year you are getting paid out. Our initial concern was that NSCs have a long maturity period with long lock-ins. This results in money getting stuck and reduction in liquidity. But this LADDER approach addresses this concern and generates cash (maturity proceeds) at the end of each year. Buying National Savings Certificates (NSCs) every month for five years and re-invest on maturity and relaxing on retirement it will work as your monthly pension as and when the NSC matures. As you can see at the end of 13th year, you don’t need to invest any more in NSCs, your accumulated and accrued interest is enough to get the full deduction of section 80C of the Income Tax act.

Conclusion

So, if you want to invest and take full advantage of the tax-saving features of NSC interest, you would have to make the adjustments in section 80C for the other tax-saving investments such as Provident fund contributions, insurance premiums, housing loan principal repayments, tuition fees, PPF, tax saving mutual funds and bank deposits. People, who are approaching to near their retirement, can consider parking their funds in five year NSCs to get a reasonable risk and tax-free return and make regular income for their retirement years through NSC-ladder approach.

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in

Informative article.